Payment solutions are required by organizations, retailers and any firms which require transactions to be carried out between them and their customers. This can either be in the form of

How to Choose the Right Online Event Payment SolutionHow to Choose the Right Online Event Payment Solution

Payment collection and its tracking are key elements of any successful event. An online payment solution lets you manage the payments and tracking activities for events in a streamlined manner.

Advantages of Credit Card Payment Solutions for BusinessAdvantages of Credit Card Payment Solutions for Business

Consumers today often prefer to pay via credit or debit card. It is vitally important for any business to they make it easy for customers to pay for goods and

Magento Payment Gateways to Help Your E-StoreMagento Payment Gateways to Help Your E-Store

With the increase of technology and the comfort it provides to users, putting up an e-store has become one of the fastest growing investments that is sure to provide benefits

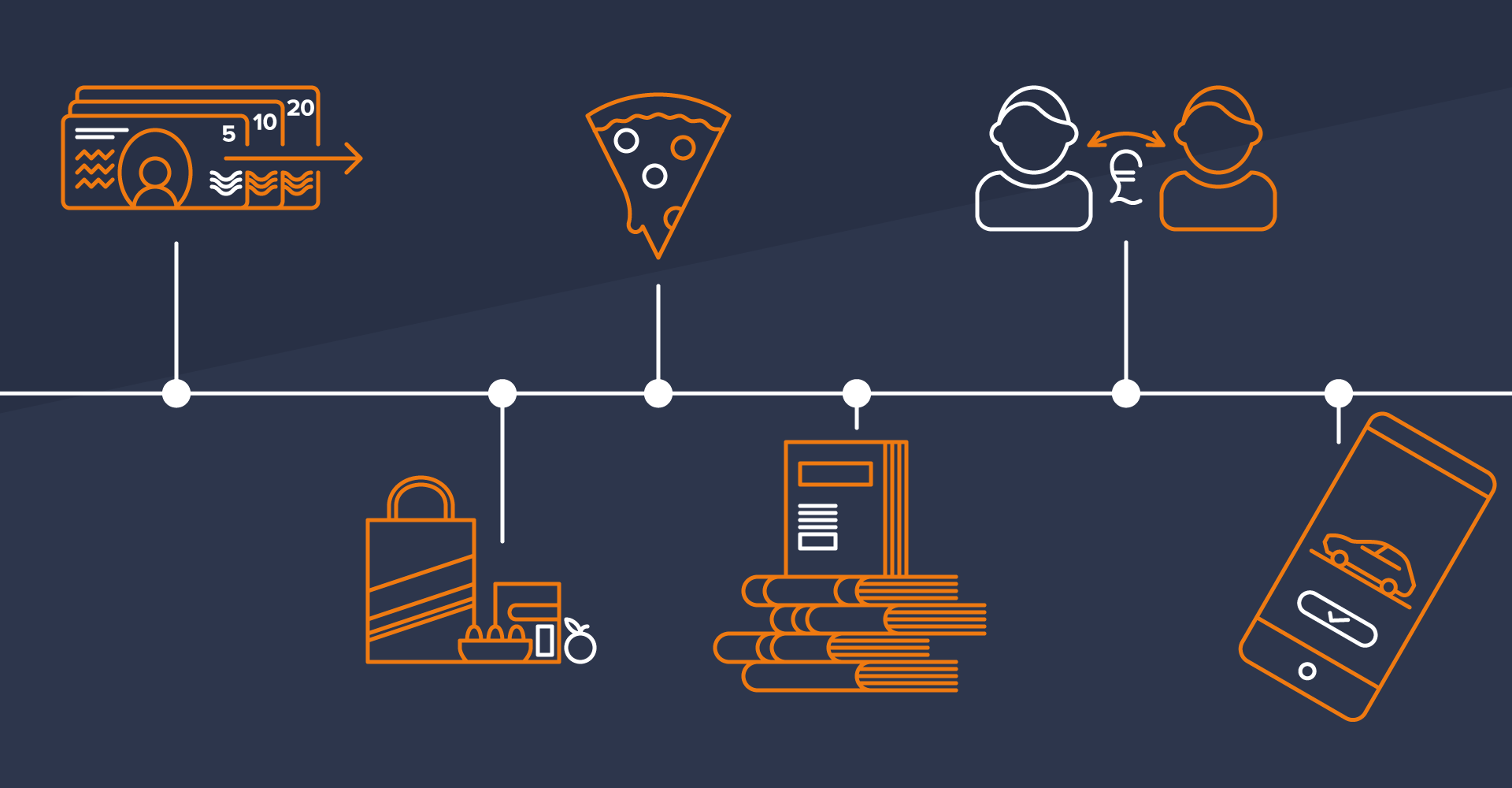

The Rise of Online Payment GatewaysThe Rise of Online Payment Gateways

The cashless payment system is growing exponentially with evolving payment methods, rising e-commerce use, enhanced broadband connectivity, and emergence of new technologies. Can increasing incidences of cyberattacks and spams hamper

E-Commerce Payment GatewaysE-Commerce Payment Gateways

The primary reason why you set up a virtual storefront is to make a sale. When visitors see your products, you want them to make a purchase. Services offered by